Writer Neal Gabler says it's not about Goldwater, it's about McCarthy:

McCarthy, Wisconsin's junior senator, was the man who first energized conservatism and made it a force to reckon with. When he burst on the national scene in 1950 waving his list of alleged communists who had supposedly infiltrated Harry Truman's State Department, conservatism was as bland, temperate and feckless as its primary congressional proponent, Ohio Sen. Robert Taft....

McCarthy was another thing entirely. What he lacked in ideology—and he was no ideologue at all—he made up for in aggression. Establishment Republicans, even conservatives, were disdainful of his tactics, but when those same conservatives saw the support he elicited from the grass-roots and the press attention he got, many of them were impressed. Taft, no slouch himself when it came to Red-baiting, decided to encourage McCarthy, secretly, sealing a Faustian bargain that would change conservatism and the Republican Party. Henceforth, conservatism would be as much about electoral slash-and-burn as it would be about a policy agenda.

Speaking of the GOP's legacy, we could be looking at spending $8.5 trillion ($8,500,000,000,000) to clean up the post-Shrub mess:

Just last week, new initiatives added $600 billion to lower mortgage rates, $200 billion to stimulate consumer loans and nearly $300 billion to steady Citigroup, the banking conglomerate. That pushed the potential long-term cost of the government's varied economic rescue initiatives, including direct loans and loan guarantees, to an estimated total of $8.5 trillion -- half of the entire economic output of the U.S. this year.

Nor has the cash register stopped ringing. President-elect Barack Obama and congressional Democrats are expected to enact a stimulus package of $500 billion to $700 billion soon after he takes office in January.

The spending already has had a dramatic effect on the federal budget deficit, which soared to a record $455 billion last year and began the 2009 fiscal year with an amazing $237-billion deficit for October alone. Analysts say next year's budget deficit could easily bust the $1-trillion barrier.

Happy times, happy times.

Via Talking Points Memo, President-Elect Obama will announce Hillary Clinton as his nominee for Secretary of State tomorrow in Chicago:

Obama plans to announce the New York senator as part of his national security team at a press conference in Chicago, [Democratic officials] said Saturday. They requested anonymity because they were not authorized to speak publicly for the transition team.

In unrelated news, today is the last day of the Atlantic hurricane season.

Why? Why? Why?

The only thing that makes sense to me: someone wants to start a war. I hope to all humanity India and Pakistan keep their senses over the next few days. So do the Indians and Pakistanis, I expect.

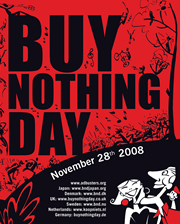

Today (in North America; tomorrow worldwide) is the 17th Annual Buy Nothing Day, "sponsored" by Adbusters:

Today (in North America; tomorrow worldwide) is the 17th Annual Buy Nothing Day, "sponsored" by Adbusters:

Suddenly, we ran out of money and, to avoid collapse, we quickly pumped liquidity back into the system. But behind our financial crisis a much more ominous crisis looms: we are running out of nature… fish, forests, fresh water, minerals, soil. What are we going to do when supplies of these vital resources run low?

There’s only one way to avoid the collapse of this human experiment of ours on Planet Earth: we have to consume less.

It will take a massive mindshift. You can start the ball rolling by buying nothing on November 28th. Then celebrate Christmas differently this year, and make a New Year’s resolution to change your lifestyle in 2009.

It’s now or never!

Calculated Risk hits the nail on the head: "[W]hat happens to U.S. interest rates if China slows their investment in dollar denominated assets?"

Hint: nothing good...

Essay by Liar's Poker author Michael Lewis, in December's Conde Nast Portfolio:

In the two decades since [1989], I had been waiting for the end of Wall Street. The outrageous bonuses, the slender returns to shareholders, the never-ending scandals, the bursting of the internet bubble, the crisis following the collapse of Long-Term Capital Management: Over and over again, the big Wall Street investment banks would be, in some narrow way, discredited. Yet they just kept on growing, along with the sums of money that they doled out to 26-year-olds to perform tasks of no obvious social utility. The rebellion by American youth against the money culture never happened. Why bother to overturn your parents' world when you can buy it, slice it up into tranches, and sell off the pieces?

Via Calculated Risk, Merriam-Webster has declared "bailout" its word of the year:

The word "bailout," which shot to prominence amid the financial meltdown, was looked up so often at Merriam-Webster’s online dictionary that the publisher says it was an easy choice for its 2008 Word of the Year.

The rest of the list is not exactly cheerful. It also includes "trepidation," "precipice" and "turmoil."

"There's something about the national psyche right now that is looking up words that seem to suggest fear and anxiety," said John Morse, president of Springfield-based Merriam-Webster.

Go figure.

...Citibank just emailed me a notice that all of my deposits are protected by the FDIC. I wonder why they're telling me now?

More: Via Paul Krugman, an informed rundown of what this means:

Apparently Citibank and the U.S. government (i.e., we taxpayers) have reached a deal whereby we will backstop something like $300-billion in screwed assets on Citi's balance sheet. ... Here is the gist:

- Citi will carve out $300-billion in troubled assets, which will remain on its balance sheet

- The first $37-$40-billion in losses on those assets will go to Citi

- The next $5-billion in losses will hit Treasury

- The next $10-billion in losses will go to the FDIC

- Any more losses will go to the Fed

- There will be no management changes at Citi, because, you know, they are all fine and upstanding people who have done nothing wrong

- There will be some compensation limitations, but those have not yet been made clear

To be clear, this is not a "bad bank" model. Assets are not, apparently, being taken off the Citi balance sheet and put into another entity walled off from the Citi biological host. Instead, they are being left on the Citi balance sheet, but tagged and bagged for eventual disposal via taxpayers.

Biggest...bank...in the world...and we're stuck with the Administration that opened our veins for another 57 days.

Josh Marshall: "One country cannot stand a once in a century economic crisis, two wars and Norm Coleman. We have limits."